How fintech is powering inclusive growth in Africa

Over the last decade, a wide variety of new fintech innovations have gained momentum in Africa. These developments are making banking across the continent more convenient for everyone, but are playing an especially significant role in meeting the needs of un(der)served communities who previously had little or no access to traditional financial services.

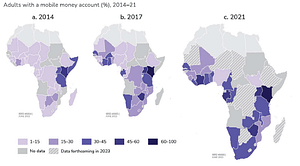

The COVID-19 pandemic reaffirmed the importance of financial inclusion, specifically in terms of digital financial services, as the world called for more contactless transactions. According to the World Bank’s latest Findex Report, more than one-third of adults in developing economies who paid a utility bill from an online account did so for the first time after the start of the COVID-19 pandemic. In Africa, these types of transactions are increasingly completed by mobile phone. The diagram below shows the growth in mobile money accounts across Africa from 2014 to 2021.

Source: Global Findex database 2021

Fintech Investment Opportunities in Sub-Saharan Africa

Africa is ripe for investment in the fintech sector. The region’s unique economic and demographic characteristics present an outstanding opportunity for disruptive financial technologies and business models. According to the McKinsey report Fintech in Africa: The end of the beginning (August 2022), fintech is the fastest growing industry in Africa, with 2021 fintech investment in Africa reaching over USD 1.6 billion and over 150 deals; that’s more than two times the value in 2020.

The current fintech revolution is mainly being led by South Africa, followed by Nigeria and Kenya. However, fintech investments are gaining traction in other countries within the region as well, driven by the potential for high returns, sustainable growth and social impact.

Much of this current fintech revolution is being instigated by startups and scale-ups that were born and bred in Africa. These locally founded businesses have a distinct advantage over international players: a deep understanding of the unique needs of their consumer base. Additionally, they are designing solutions which are tailormade to deliver accessible financial services to previously excluded groups.

However, cash is still king in Africa. This presents huge opportunities for further growth and investment in the fintech industry. Africa’s deep mobile penetration, youthful population, increasing disposable income, and large diaspora living abroad, coupled with improved regulatory frameworks (such as new sandbox programs introduced in Kenya, Nigeria, South Africa, Rwanda and Zimbabwe) creates a strong backbone for continued fintech expansion. McKinsey estimates that Africa’s financial services market could grow by about 10 percent annually, reaching USD 230 billion in revenues by 2025.

Impact of Financial Inclusion in Africa

Fintech is a game changer on a number of levels. One major advantage is that these African innovations are actively addressing the needs of un(der)served business audiences like SMEs, as well individuals – especially previously unbanked populations like women, youth and rural communities. But the true impact of financial access goes far beyond enabling transactions. Increased access to financial services also increases employment, boosts incomes and is directly linked to improved outcomes for access to healthcare, poverty alleviation, education, agriculture, and gender equity.

Image by Billy Miaron

Another concrete way fintech is having a local and global impact is by breaking down the barriers to cross-border transactions. Many national economies and individual households in Africa rely on remittances – money sent back home by family members who have moved abroad. Today’s fintech innovations have made these types of transfers easier than ever, reducing transaction fees and facilitating multi-currency banking services. One company at the forefront of these developments is MFS Africa. As the largest digital financial hub in Africa connecting over 320 million mobile money wallets in 35 countries, we are proud of the milestones our portfolio company has achieved in making cross-border payments inclusive for everyone.

Goodwell’s Commitment to Financial Inclusion

At Goodwell, we remain committed to expanding financial inclusion through digitalization. Because up to 65% of adults remain unbanked in sub-Saharan Africa (SSA), according to the World Bank Global Findex 2021 Report, financial inclusion is an especially urgent issue. Our strategy is to help disrupt the financial sector in SSA by investing in companies who specialise in digital financial technology. Digital financial services are a key driver for expanding access to basic financial products and services to previously excluded consumers.

Our strong portfolio of investee companies championing financial inclusion in Africa is clear evidence of our commitment. To date, we have invested in Asante Financial services, Baobab Microfinance Bank, Inclusivity Solutions, Musoni System, MFS Africa, Paga, Oradian, Nomanini, MFS Africa, Lidya, and Innovative Microfinance. We are proud of the revolutionary impact these companies are delivering to make financial services more accessible to un(der)served groups in Africa. And what remains important to us is supporting locally rooted solutions that are socially impactful and financially sustainable at the same time.

Learn More About Goodwell’s Investment Journey

Fintech is just one of the sectors that offers impressive potential for creating a more inclusive society across the African continent. Therefore, Goodwell’s investment portfolio also focuses on growing businesses in the areas of agriculture, mobility/logistics, energy and education. To learn more about our investment strategy and the types of companies we invest in, please explore our website. For additional information, contact Nico Blaauw: nico@goodwell.nl